Flying High

When a flying school in the south of England went into liquidation Marriott & Co. were asked to assist with a sale of the school’s assets which included a 1980 Cessna F152 aeroplane.

Our client being an expert in the field, noted that the training goggles in our sale were in fact foggles, used to simulate foggy conditions for the wearer!

With bespoke and tailored marketing, the result from our online auction exceeded all expectations.

For further information about our valuation and disposal services, please call us on 01252 712 083.

An additional 5 hours of bidding

We were instructed to provide a valuation for a kitchen and bathroom design and installation company and then dispose of the company’s assets.

We held an online auction of the display and trading stock. After a busy marketing period and viewing day, the auction was a huge success, scheduled to end at 3pm, with overtime bidding the auction ran on an additional five hours!

For further information about our valuation and disposal services, please call us on 01252 712 083.

Plans change but the results were fabulous

Marriott & Co. handled an interesting case where a private, hospitality client had purchased the assets from the Administrator of a top London digital printing company. The client planned to use the assets to create the graphics ‘in-house’ for their various ventures, hotels and clubs. Their plans changed and we were instructed by the client to arrange a well marketed online auction with fabulous results.

For further information about our valuation services, click here.

The difficult we do immediately….

Here’s a little insight into the way we work.

Our client’s purchase of a printing company was conditional upon a valuation of the company’s production plant and equipment.

As we retain a specialisation in the printing industry’s assets, we were perfectly placed to provide the valuation, but we were naturally concerned to learn that the site inspections of over twenty machines at three locations and the valuation researches and report preparation had to be completed within three working days.

We therefore allocated two RICS Registered Valuers to the task which resulted in a multi-million pound valuation being presented to our client in time for the sale completion.

Another happy client!

We value the relationship

It’s the relationship which holds the value…

We were delighted to hear from an old client for whom we undertook a valuation of their printing plant & machinery in Birmingham some 23 years ago.

Within a matter of days from the instruction a fresh valuation was carried out, which contained much of the equipment we first visited in 1998!

This case demonstrates the considerable goodwill and professional reputation Marriott & Co. has built up over the 34 years we have been trading.

An accurate valuation is king

It is the Director’s role to take care of a company’s and its shareholders’ business assets – including a declaration to Insurers as to the correct sums for which all tangible assets should be covered. In order to avoid the potentially disastrous consequences of under-insurance, this must be correct – the responsibility for which can be passed to a professional Valuer.

Insurance Valuers themselves need Professional Indemnity cover. In the case of UK companies with production facilities overseas the Valuer may also require other cover plus travel insurance, visas and inoculation certificates.

For further information about our valuation services, click here.

All aboard

Instructed by the Liquidator of a West Sussex travel company, we undertook a RICS valuation and subsequently an online auction of its buses and coaches. Having witnessed the tremendous auction results including certain vehicles being sold and exported to Ireland, we were contacted by a private client to sell their buses and coaches from their site in Croydon.

For further information about our services, click here.

An honour for Marriott & Co.

An invitation to act as an Expert Witness in accordance with the Civil Procedure Rules is both an honour and a worry.

It is an honour because our reputation and personal CVs will have been scrutinised, and a worry because we know our report is likely to be challenged by one party or the other – and may result in a court attendance to defend our conclusions.

Our reports are therefore the result of much concentration involving thorough consideration of the facts, extensive researches, and meticulous report preparation.

For further information about our expert witness and litigation support work, click here.

Neither Shaken nor Stirred

Whilst recently holidaying in Portugal, I found myself one damp lunchtime sipping a rather potent ‘007 Martini’ in the opulent ‘spies bar’ at the Hotel Palacio in Estoril, my mind drifting into Bond film memories of double agents, casinos and Aston Martins.

Apart from it being a wonderful destination, I am here because this hotel’s image is on the front cover of a book currently being read by my partner and whilst we had our holiday base in Lisbon, it seemed rude not to take the short journey to Estoril. It’s where, I understand Ian Fleming, an intelligence officer in the Royal Navy stayed during the second World War whilst devising ‘Operation Golden Eye’, and it is situated next door to the Estoril Casino a favourite haunt of Mr Fleming, hence Casino Royale was born.

Because of Portugal’s neutrality in the war, several royal families went into exile in Estoril, which evidently became known as the “Coast of Kings”. The Hotel Palácio was the chosen home of members of European royalty and was also the place for British and German spies, who could often be found in its bar. I understand Graham Greene would also stay here. The intrigue and espionage inspired novelists and filmmakers and the Hotel served as the set for the movie “On Her Majesty’s Secret Service”.

In August 2019 one of the Bond DB5’s was sold by auction, achieving $6.2m at the world’s biggest classic car auction in California. Once owned by the JCB billionaire Lord Bamford, it became the world’s most expensive DB5. However in the same auction a 1994 McLaren F1 sold for $19.8m, so the DB5 might be considered something of a bargain!

Whilst Marriott & Co would generally leave the real classic cars to the experts in that field (some of whom we have teamed up with for valuation purposes in the past), we have experience selling Aston Martins and will always be ready to auction your company cars and vans. We fully expect that you will not be either shaken or stirred by the results we achieve!

Judith Campbell, Director of Disposals

From Tear Drops to The Shard

Having been instructed to find buyers for two major glass tempering plants in the last year, it is not unreasonable to consider ourselves well experienced in valuing and selling glass processing machinery.

The first assignment took us into Kent and we undertook a RICS valuation of the business and assets, it was hoped that a buyer for this whole glass processing facility might be found. After much negotiation and deliberation, the various companies that had expressed an interest felt unable to take on the risk of such a large operation. We were therefore instructed to sell the vast array of glass processing machinery by online auction. A very successful sale with over 400 lots followed with Buyers attending from all over Europe, and many machine’s being exported to Ireland.

The main glass tempering furnace, used mainly for tempering architectural glass panels such as the 11,000 panels used on the Shard, was some 40 metres long and made by leading Italian manufacturer Mappi, it had been installed and used in the Kent facility for just 18 months. With a further comprehensive marketing period of two months Marriott & Co. found it’s Buyer by private treaty. We oversaw the furnace’s safe dismantling and removal from the UK site to its new home in Germany.

The second plant we were instructed to sell was even larger at 55 metres long and manufactured by Cooltemper, it comprised two main furnaces, the only one of its kind in the UK, and was sited this time in Essex. It was considered that this plant may best suit the American market. However, the Marriott & Co. marketing found the plant it’s new home less than an hour away and it therefore remained in the UK. This furnace was mainly used for tempering thinner glass for double glazed units.

In both cases the plants were sold for six figure sums. The client, a finance institution, was very pleased that Marriott & Co had managed to limit its potential losses by finding appropriate buyers in the short time scales, following bespoke marketing campaigns.

Whether a single asset that is best sold by private treaty, or a complete production facility whereby the best sale would generally be an online auction in lots, Marriott & Co will provide best advice to maximise realisations for all of our clients’ assets.

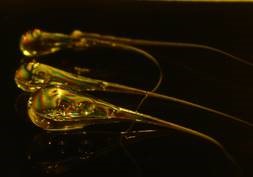

The glass tempering process works by compressor convection technology, first heating the glass to vast temperatures and then cooling very quickly. The glass becomes several times stronger than ordinary glass and can be used safely for many purposes. It is thought that ‘Prince Rupert’s drops’ were the first form of toughened glass, created by dripping molten glass into cold water to form toughened glass beads. The process creates residual internal stresses and counter-intuitive properties. Named after Prince Rupert of the Rhine who brought them to the UK in 1661, where the Royal Society of London then performed scientific studies on the properties of the drops.

Judith Campbell, Director of Disposals